Class News

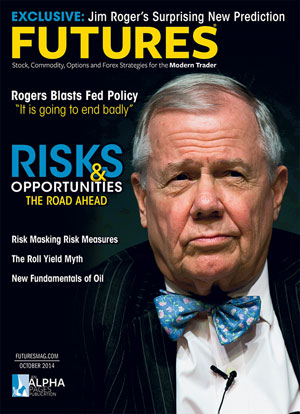

Jim Rogers '64 interviewed twice in Futures Magazine

The October 2014 issue of Futures Magazine featured a cover story titled "Jim Rogers on the Fed and global economics," as well as another interview with Jim titled "OFF TOPIC with Jim Rogers." These articles are reproduced below.

Jim Rogers on the Fed and global economics

Jim Rogers has made money as an investor over several decades by learning about and understanding global long-term fundamental drivers. He has been an outspoken critic of our current Federal Reserve Board policy and of government deficit spending. With the current bull market pushing six years and the historic open-ended quantitative easing policy nearly finished, we thought it would be a good time to check in with Rogers, who now lives in Singapore, regarding the bull equity market, commodities, and the long-term effect of this extraordinary period of central bank activity. He shares his thoughts on the global economy and offers some surprising views on potential economic and political changes.

Futures Magazine: The current bull market, which some people view as a creation of central bank policy, has been going on for more than six years without a serious correction. Is one due?

Jim Rogers: [There is] a worldwide ocean of artificial liquidity; the ocean is getting bigger all of the time. It’s the first time in recorded history that all the major central banks have been printing money. The Japanese said they would print unlimited amounts of money, Europeans said we will do whatever it takes, the English say ‘“let us in too,” the Americans — you know what they are doing. [The Fed] says it is cutting back on its purchases but in the meantime the money printing continues. The people who are getting this money are having a wonderful time; and their friends are having a wonderful time, unfortunately it is artificial and it has got to end someday. I don’t know when “someday” is, I’m terrible at market timing in the best of times, [let alone] when [we are seeing something] that never happened in world history. When it ends it is going to be a nightmare for everyone concerned except the people that get it right. Most of us will not get it right. We have had economic setbacks in America every four to six years; we are going to have them again. The one in 2008 was worse than the one in 2002 because the debt was so much higher. The debt has gone up a staggering amount since 2008. The next time it is going to be worse. I hope we all survive it. If we somehow survive the next one, then for the one after that: I doubt if anyone could survive because the debt will be so high.

FM: Normally a bull market lasts about as long as the post credit-crisis boom, but no one would mistake the last six years as an economic boom. Can a downturn hit right when we begin seeing a strong recovery?

JR: The people in Washington, the academics say [a stronger recovery] is coming. Let’s say they are right, it still doesn’t preclude somewhere along the line an economic setback — and when it does hit, it is going to be staggering because the situation is so much worse.

FM: You had been very critical of the performance of Ben Bernanke and the Federal Reserve. Playing the devil’s advocate one could say the Fed averted a disaster or delayed it, and now we have to see if the Fed can safely unwind from this extraordinary accommodation.

JR: They would say “yes” and their apologists would say “yes, they saved the world.” My response to that is go back to the early 1990s. The Japanese did the same thing. They refused to let people fail and the Japanese had a lost decade, and a second lost decade; even today the Japanese stock market is still down 70% from where it was 24 years ago. Yes, the Japanese central bank saved them in 1990 but most people would prefer it not to have happened that way. Scandinavia had the same problem in the early 1990s. They let people fail. They had a wretched two or three years but after they got over the pain they have had a prosperous two decades in contrast to Japan. This way doesn’t work.

FM: What else could the Fed have done?

JR: [They could have done] exactly what the Scandinavians did. In the early 1920s the Federal Reserve raised interest rates. Washington balanced the budget. We had a horrible year or two but then we had the greatest economic decade in American history in the1920s. It ended badly because of excesses. You bite the bullet, you take the pain. The way the system is supposed to work is people get into trouble, they make mistakes, somebody comes along, reorganizes, and they start over from a stronger base. What the West has done is we have gone in and taken the assets away from the competent people, given them to the incompetent people, and said to the incompetent people, “Now you compete with the competent people with their money.” It is absurd economics, it is absurd morality. It’s insane. Central bankers will tell you it is great. They say don’t worry we are going to withdraw from this slowly and gradually. In 2008 when they were contemplating this, [FOMC] minutes showed that they didn’t know what they were doing but they didn’t know any other choice. …You asked how it is going to end, it is going to end badly. Like Japan, if we are lucky. When the next problem comes, because it is going to come, it is going to be a nightmare.

FM: Many people worried that QE would create extremely high inflation, perhaps even hyperinflation. That has not happened. Why? Where the critics wrong or is that still a serious threat?

JR: The government has always said there is no inflation and when inflation comes up they change their accounting methods to show no inflation. For those of us who shop, we know that prices are up. Just look at your food bills, your education bills, your transportation bills, any bills. Prices are up. The government says they’re not. I have more confidence in John Williams’ (founder of shadowstats.com) numbers that the (Bureau of Labor Statistics). They both can’t be right but I know from my personal life and from people who write to me that the BLS is not right. If you look at how the BLS does its numbers, something like 22% is rental income. Now when [housing] prices were going through the roof, they said, “well rental prices aren’t going up because people are buying houses so there is no inflation,” then when housing prices collapsed they said rental prices are down. When 22% of your prices are based on rent, or rental equivalents, which they can jiggle with, their whole methodology [is questionable].

FM: We (and much of the world) have been in a zero interest rate environment for six years. What will be the impact?

JR: A lot of people are being ruined. Anybody who saved and invested for the future is being destroyed because they are earning nothing on their savings. Any pension plans, endowments, etc., are suffering because they invest for the future and are finding that their situation has gotten worse. We are doing this at the expense of people who save and invest. We are doing it to bail out the people who borrowed huge amounts of money. The consequences are already being felt. History shows that when you destroy your savings and investing class, it leads to gigantic social problems down the road. More and more people are unhappy in the U.S. and the world, the mood is not great, at least when I am there. We know something is wrong; we may not know it is because the savings and investing class is being destroyed or that the endowments and insurance policies are coming under duress but everybody knows something is wrong. It is leading to more and more social unrest, more disillusionment, and it is going to get worse. Turn on any TV, open any newspaper. It is getting worse.

FM: It has been six years since the credit markets imploded. Analysts point to a period of anger that generally occurs seven years after such an event. Is that what we are seeing?

JR: Of course that is what is happening. One reason it is happening is because there is inflation in the world despite what the BLS says. You have so much social unrest in much of the world because food prices are going higher . If you are a lady who goes to the shop every day you know that the price of sugar is going up or wheat or bread. A lot of these people are finding they cannot survive the cost of living. In America we don’t have inflation but in the rest of the world they do and you are seeing more and more social unrest. People who are fat and contented don’t really care whether the Christians or the Jews or the Muslims are saying X,Y or Z; they are too busy having fun and making money but when things go wrong they look for someone to blame. Right now things are going wrong in many parts of the world even though the Dow Jones is at an all-time high.

FM: Is the dollar’s status as the world’s reserve currency in jeopardy?

JR: There is no question that the U.S. dollar is a terribly flawed currency. I own U.S. dollars, have for a while, but that is because there’s going to be more turmoil and when turmoil comes people have always fled to the U.S. dollar. It is not a safe haven but it is perceived as a safe haven so when the next bout of turmoil comes people will move there again. But many people in the world are looking for a replacement. A lot of people are terrified of the dollar, not just for economic reasons but for political reasons. [People who] are obeying laws in their own country suddenly find themselves paying staggering fines to U.S. (regulators). America says ‘we don’t care if it is not illegal [there]; we think it is bad, you have to pay.’ I am not the only person who knows the [United States] is the largest debtor nation in history, others know it. In recent years the guys in Washington, if they don’t like you, will block your assets and there is not a lot people can do about it, but they are trying to figure out ways to get away from the dollar and they will.

FM: What is your opinion of Bitcoin? Is it an example of people looking for an alternative to the dollar?

JR: I’m not knowledgeable about Bitcoin. I know there are at least a dozen imitators now. It is back to what I said before, the world knows we have a problem and many people are looking for a solution. It could be something like Bitcoin. Maybe people are not going to buy gold and come up with something new. Gold has been out of favor; I don’t expect [it] to stay out of favor. Right now the whole world has to have U.S. dollars and have to go through the American banking system. That is proving to be a bad situation for many people and they are going to do something about this whether America likes it or not.

FM: Is this reversible?

JR: Yes. We can balance the budget. We can open our borders, our financial markets, we can cut out the gigantic litigation, and we can stop blaming all our problems on foreigners. We can change a lot of things. Is any of that going to happen? No. Not until a crisis. Many countries have gotten in this situation in the past and none have done anything until there is a crisis and then they usually make it worse like Japan in the early 1990s.

FM: We are near a turning point of sorts. QE will most likely end in October and the economy (and market) that has been growing grudgingly will need to stand on its own. Can it?

JR: Somewhere along the line the economy is going to suffer and then, as the pain sets, in people will be calling Washington screaming "you will have to save civilization," and the central bank that is made up of academics and bureaucrats will panic and do something. The money will flow whether it is called QE4 or something else, which will mean "don’t worry guys, we will save you" and then we will be off to the races again and I suspect somewhere around 2015 or 2016 we will have a gigantic bubble in many markets and that will be seven or eight years after the low. Timing-wise we are long overdue. And the next one will be worse than the last one.

FM: Would a market correction of 10% to 20% be bad?

JR: No. We haven’t had even a 10% correction for three years. Normally the market has a 10% correction every year or two and it is good. It certainly wouldn’t be a bad thing. A bear market wouldn’t be a bad thing. There is a lot of complacency. A lot of exuberance that usually leads to a misallocation of resources. I do know that those guys in Washington don’t have the courage of their convictions. Second, they have no knowledge or experience, so when things start going wrong they will panic, and all they know how to do is print more money and that is what they will do in their panic.

FM: Should they have done nothing in 2008?

JR: Yeah. Just like Scandinavia in the early 1990s; America in the 1920s. Competent people reorganize the assets and start over from a sounder base. We have propped up the incompetents. It is horrible economics. I’m not suggesting this would have been fun but instead of having a lost decade or two when the day of reckoning comes — the Fed’s balance sheet has quadrupled in six years — it will be a gigantic mess. Had they let [the banks] fail, it would have cleaned out the system and we would be on a big roll by now.

FM: You still believe we are in the midst of the commodity bull market. How do you see that evolving?

JR: I would remind you that in the [equity] bull market from 1982-2000 we had many huge setbacks. In 1987 stocks went down 40% to 80% worldwide; 1989, 1990, 1994, 1997; staggering consolidation and setbacks and every time people thought the bull market was over. It wasn’t. It ended in excess and a bubble like most bull markets end. In my view we are having that sort of period in many commodities. Gold, which I am not buying [right now], I suspect will turn into a gigantic bubble before this is over. Many other things as well. And that will be the end of the bull market. I don’t see enough huge permanent supply in most commodities to end the bull market. Look out the window, there is an artificial ocean of liquidity climbing all over the world, rising as we speak. It has never been like this in recorded history where all major central banks are doing it.

FM: Is there a risk of a major event in October?

JR: I am the world’s worst short-term trader. I don’t expect a collapse any time soon. Even if we start to have a normal setback, Yellen is going to panic. If the market is down 12% she is going to be getting a lot of phone calls, much less if it’s down 22%. The market hasn’t been down at all. If some collapse comes — which I don’t expect — it is going to be panic and hysteria, and Yellen is going to run those printing presses even faster.

FM: You are traveling to North Korea. Why? How difficult is it to get in?

JR: It is getting much easier. If I could put all of my money in North Korea I would. It is the most exciting investment destination right now. I can’t put anything in North Korea, I am an American, I would go to jail. But I can see the changes. Where China was in 1980, where Myanmar was in 2011, is happening [now in North Korea]. America again will be the last to know but it is happening.

FM: I thought North Korea was still a closed society. Are they making reforms?

JR: The problem is that everyone is looking to American propaganda. [Kim Jong-un] has been there less than three years, he grew up in Europe, he knows there is a different world. His generals — more importantly — when they were lieutenants and captains, used to go to Shanghai and Beijing. They’ve come back and say you can’t believe what happened in Beijing the last 30 years and see nothing has happened [in North Korea]. There are 14 free-trade zones this year in North Korea; you can take bicycle tours, they have international marathons, they just opened an international ski resort. All this is happening now, it is not something that is going to happen, these are things that have happened and are happening now. Unfortunately, [Americans] are not allowed to do anything but the Russians and the Chinese and a lot of other people are allowed to do things and they’re rushing in and doing a lot of things in North Korea.

OFF TOPIC with Jim Rogers

Rogers says Korea to unify within 5 years

The Alpha Pages: We and our readers are interested to know what you learned on your trip to North Korea.

Jim Rogers: People have mobile phones everywhere. I was allowed to take my mobile phone into the country and my computer. I could not do that before. They didn’t work, but I could take them into the country. I could have applied to the government to get access, don’t know if they would give it to me, but I was only there five days.

Many Asian countries are having goods manufactured in North Korea. They are doing a lot of business. A lot of things are happening already, more than I realized. I certainly knew the Chinese were pouring in. When I crossed the border I was amazed that there were hundreds of Chinese crossing the border. I went and saw the new docks that the Chinese and Russians are building. I was in a town called Rason. Rason is the Northern-most ice-free port in Asia. The Russians have just built a new dock there. Everything I am telling you is happening now. It is not something that is going to happen. This is all new stuff that America is not talking about because it takes a while for American bureaucrats to catch on to what is going on in the world. It is exciting; unfortunately since I am a citizen of the land of the free there is nothing I can do.

TAP: You talk about investing. Are there any industries there to invest in?

JR: In the 1970s North Korea was richer than South Korea; communism can ruin anything, it certainly ruined North Korea. They have vast mineral resources that can be exploited, will be exploited. The communists didn’t do a very good job but there is plenty of stuff to be exploited. Fishing: They have coastlines on both sides of the border. Manufacturing: They are cheaper than China, probably cheaper than most places in the world.

TAP: Is the new regime building a manufacturing base similar to what China did several decades ago?

JR: I was only in this one region this time but I saw that manufacturing is exploding. One company I saw went from having three or four factories five years ago to having 16 factories. Small, but that is the sort of thing that is happening.

TAP: Is this all happening under the radar? Do you have any expectation that there will be an official [reform]? A free market experiment [as] in China?

JR: The [United States] will be the last to know and certainly the last to announce just as we were in China, just as we were in Russia, just as we were in Myanmar. It’s happening. The Japanese went there and had a big wrestling festival. Wrestlers from all over the world were there. They had an international marathon in North Korea this year. You can take bicycle tours in North Korea now. This is not something that is going to happen, it is happening now. And these things were totally inconceivable three years ago before the old man died but it is all happening. You don’t read about it in the American press because the American press is controlled by the State Department and by American propaganda. Japanese Prime Minister Abe loosened some of the sanctions against North Korea. You don’t know about it because you live in [America].

It’s happening because of the kid. [Kim Jong-un] grew up in Switzerland. He knows it’s a different world. There is a black market now in just about everything. The Koreans know there is all sorts of stuff.

TAP: Where do you see this going: A year from now, five years from now, and ten years from now?

JR: North and South Korea will merge within five years and then Korea will be the most exciting country in the world for a decade or two. No one else will agree with that but I will remind you that if someone said in 1985 that Germany would be unified in five years they would have the same reaction you did.

TAP: Technically South Korea and the United States are still at war with North Korea; doesn’t America have to have a role in having that happen?

JR: America still has [28,500] troops stationed in South Korea. America is part of the situation; part of the problem if you ask me because they put on these war games every year. If country X is putting on war games with Canada every year what do you think America’s reaction would be? They have these war games every year, partly because they have always had these war games and bureaucracy grinds very slowly. I had dinner with the South Korean Defense Minister earlier this year and I said to him — he knew about my predictions — why don’t you call off the war games next year. He was shocked, he never thought of such a thing.

TAP: Hasn’t North Korea fired on South Korea recently?

JR: You read the American press. What happened was South Korea and America were having war games shooting live ammunition in rehearsal and a lot of it landed on a North Korean island and the guys shot back. What would you do? Yeah that happened. Not the way it was presented in the American press.

TAP: North Korea has been a force for destabilization in the world; the United States spends a lot of money helping to defend South Korea so you would think this would be good news and welcome. Why isn’t the United States part of this?

JR: You would think everything that you just said. It would be fantastic for America, for Korea, for the world, for Northeast Asia if this stops. In America you have no clue as to what is going on. There are forces at work that prosper from, thrive on this state of affairs.

TAP: Does not being a part of this damage the United States in terms of global competition?

JR: We don’t want this to happen. We have [28,500] troops in South Korea and with reunification those troops will have to leave. The Pentagon likes having troops stationed in Northeast Asia. When reunification comes I assure you part of the deal is going to be American troops go home. There are lots of people who defend the status quo. It happens with Cuba. Many people are [investing] in Cuba, not us.

TAP: Were you able to talk to any government officials?

JR: Yeah, I went to see them, they want me to invest; they want us all to invest. There is a whole department designed to attract foreign investment. There were all sorts of incentives they were giving, etc. I had to say I am sorry, I’d like to do something but I am an American citizen and it is illegal. I am now in the process of trying to find out what is illegal and what isn’t. I have the impression that everything is illegal.

TAP: Did you meet will Kim Jong-un or any of his trade ministers?

JR: I was in Rason. I wanted to go to Rason because that is where the Russians just rebuilt the railroad across Siberia into Rason and that is where they are rebuilding the port. Rason is going to become the most important port in Asia in the next decade or two. If you put goods on the train in Rason, they get to Berlin two weeks earlier [than the current alternative]. Putin knows this, the Koreans know this, the Chinese just put in a railroad across China and Kazakhstan to get things to Europe much faster so geography is changing as we speak. You wouldn’t know it if you watch (American TV).

I went to the market, you could get anything. Stuff that I don’t even have myself. It is all there. All the food you want. If you want ice cream you got it. Good ice cream.

TAP: From what you said there appears to be an acceptance of this even in the South. Are there signs of a softening of the tensions, some cooperation?

JR: I was quoted on the front page of the largest South Korean newspaper in December talking about unification coming, and that it would make Korea the most exciting country in the world. You would then have a country of 75 million people on the Chinese border with vast natural resources in the North with cheap, educated, disciplined labor combined with vast amounts of capital and knowledge in the South. There is no country in the world that would be as exciting. To my shock and delight, the president of South Korea in her New Year’s address talked about how this American said it is going to be a jackpot when we unite. Most politicians would have ignored it. She didn’t, she picked up on it and said "this could be a jackpot for Korea." So some people are thinking about it. The polls now favor unification in the South. Even Japan is opening up to the changes. The biggest opponent at this point is Washington, D.C. The Chinese and Russians are all in there.